Welcome to the Smart Solo Money Hub—your space to plan, budget, and build a future that’s all yours. Whether you’re managing a single income, preparing for retirement, or just tired of confusing advice that doesn’t fit your life, you’re in the right place.

Smart Solo Money is part of the Rebuild Path in the Project: Improve Me™ Midlife Map. 💖

Take Control of Your Money & Build a Secure Future—Even on One Income

Managing money solo comes with unique challenges, and I know that firsthand. Budgeting, planning for the future, and still enjoying life-all while juggling expenses alone—can feel overwhelming.

That’s exactly why I created Smart Solo Money Hub-a space designed for independent women over 45 who want practical, no-judgment financial guidance that actually fits their lives.

💡 I believe in simple, flexible money strategies that help you feel in control of your finances-without restrictive budgets or giving up everything you love.

I’m not here to tell you to stop buying coffee or micromanage every dollar. Instead, I want to help you track your spending with ease, save for your future, and still enjoy life along the way.

Over the years, I’ve learned what works (and what doesn’t), and now I’m sharing those tools with you!

✔ Want a realistic way to manage money on one income? Start with the FREE Smart Solo Money Quick Win Subscription Audit and the Smart Money Management Series for step-by-step financial support.

Why Smart Solo Money is Different

Most finance advice assumes you have a partner to split expenses with—but what if you don’t?

The Smart Solo Money Hub focuses on real-world money planning for independent women. Whether you’re navigating budgeting, homeownership, retirement savings, or just figuring out how to enjoy life while staying financially secure, you’ll find tools and support that actually fit your lifestyle.

✅ No guilt, no rigid rules—just smart money strategies that work for YOU.

✅ Designed for women over 45 navigating finances on their own.

✅ Practical steps you can actually stick with—no over-complicated systems!

🚀 Start where you are—take one step today, and your future self will thank you.

Start with These Free Resources!

Your financial journey begins with small, smart steps. Download one (or all!) of these tools to gain instant clarity and control over your money:

Want to come back to this later?

🎯 FREE Smart Solo Money Quick Win

✅ Subscription & Expense Audit Checklist – spot and stop money leaks

📩 📌 Ready to take action? Grab your free Quick Win Subscription Audit here:

💡 Got a Tool Request?

If you're thinking, “This is helpful, but I really need a way to ____,”

please let me know! I’m always adding new tools to make smart solo money life easier.

Leave a comment or contact me here—I’d love to hear what would help you most.

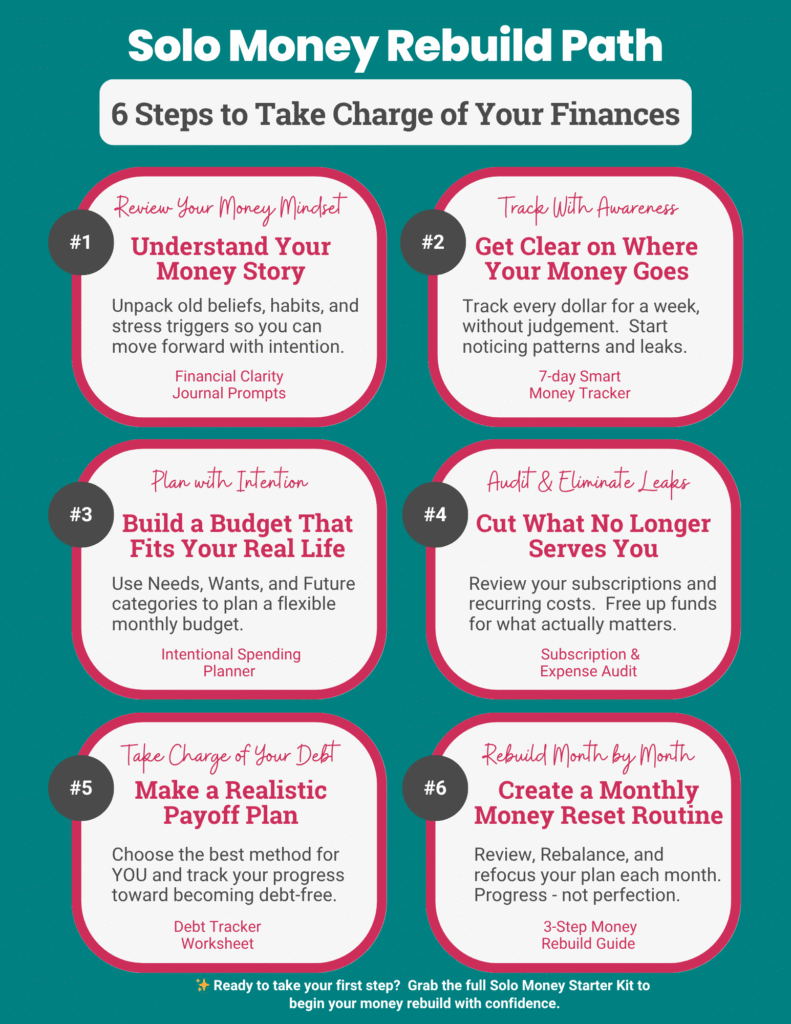

🌿 The Smart Solo Money Rebuild Path: 6 Steps to Take Charge of Your Finances

Your Starter Kit matches this path step-by-step. Follow them in order—or jump to the one that fits your needs today.

Read the Smart Money Management Series

Not sure where to begin?

Start with my foundational money series, designed specifically for independent women managing finances solo. Each step builds on the last—no overwhelm, just smart, doable money moves you can start today.

📘 Smart Money Management Series

A step-by-step money journey designed for independent women managing their finances solo.

1️⃣ Track Your Spending Without Stress

Build awareness of your money habits—without guilt or spreadsheets.

2️⃣ Identify Money Leaks & Stop Wasting Cash [the quick win freebie helps with this step]

Find the sneaky expenses draining your income and cut them with confidence.

3️⃣ Create an Intentional Spending Plan (Not a Restrictive Budget)

Use the Needs, Wants, and Future method to budget in a way that fits your values.

4️⃣ Build a Financial Safety Net on One Income

Create security and stability—even when you're the only one bringing in income.

5️⃣ Smart Debt Management for Independent Women

Pay off debt with a plan that fits your solo lifestyle—no shame, no stress.

6️⃣ Growing Wealth & Earning More

Boost your income, invest with confidence, and build real financial freedom.

📌 Bookmark this page or visit the Solo Money Hub » to follow the full series and grab your freebie.

What’s Next? Let’s Get You Financially Confident!

Managing your money solo doesn’t mean you have to do it alone. Bookmark the Smart Solo Money Hub, grab your free tools, and start building a financial future you feel good about.

💬 Have questions? Looking for a specific financial resource? Let me know in the comments!

🎯 Start now—your financial future begins today.

Check out the Smart Solo Money Shop

You'll find tools I've created to help you succeed with your finances. If you ever have problems or questions with my products, please contact me and I'll help. I just want you to reach your financial goals – in the easiest way possible!