Real steps for women in their 40s, 50s & beyond — especially if you're starting over

If you've ever felt behind when it comes to money, you're not alone.

Most “expert” checklists about financial milestones are written with a very specific kind of life in mind — steady job, dual income, no interruptions, no curveballs.

That’s not how midlife works for a lot of us.

Especially if you’re raising kids, supporting parents, rebuilding after a divorce, or managing money on your own — some of those “before 40” goals can feel like they’re from another planet.

But that doesn’t mean you’re stuck.

It just means you need a plan that works from here — not from someone else's timeline.

What if your 50s aren’t your last chance… but your real starting point?

These midlife money milestones were written with real women in mind. Not the ideal version of you, but the actual one — figuring things out one fix at a time.

You won’t find advice to max out your retirement accounts or pay off your house this year (unless that’s already on your radar). But you will find a few milestones that can help you feel steadier, more in control, and maybe even proud of how far you’ve come.

🚪 Milestone 1: Know What’s Coming In and What’s Going Out

Not a fancy spreadsheet — just a clear picture of what you’re working with.

- What’s your true take-home each month?

- What are your essential bills?

- Where is money slipping through the cracks?

This is where every Rebuild Path starts: with awareness.

🧹 Milestone 2: Clean Out Your Financial Junk Drawer

Old accounts. Random apps. Subscriptions you forgot about.

- Close unused checking or credit accounts

- Cancel anything you no longer use or need

- Locate old 401(k)s or benefits from previous jobs

This is also where your Companion File (if you use it) can help you keep things in one place.

This overlaps with the Reset path too — especially if your digital or paper clutter is adding to the stress.

🗣️ Milestone 3: Talk About Money With One Trusted Person

You don’t have to overshare — but carrying everything alone gets heavy.

- Pick someone you trust

- Share what’s stressing you out (or what you’ve fixed!)

- Ask for encouragement, not advice

Even one honest conversation can shift how heavy money feels.

💗 Don’t have a go-to money person yet? I’m always happy to hear your story — you can leave a comment below or send me a note by email right here.

🦺 Milestone 4: Build a Tiny Emergency Buffer

$100 set aside is not nothing. It’s a win.

- Open a separate account or cash envelope

- Set a small recurring transfer — even $5 counts

- Label it something meaningful (“peace fund,” “future me,” etc.)

This isn’t about having it all together. It’s about having something to catch you.

🔐 Milestone 5: Make a “What If” Plan

Emergencies don’t wait until you feel ready.

- Create a simple doc with the basics: account names, contact info, key dates

- Decide who could help access things if needed

- Consider preparing a digital “Wallet Snapshot” in case of crisis or loss

Want to come back to this later?

This isn’t worst-case thinking — it’s protective thinking.

💳 Milestone 6: Understand Your Debt (Without Shame)

Debt isn’t a character flaw. It’s a number — and numbers can be worked with.

- Add it up (even if it hurts)

- Sort it by interest rate or emotional weight

- Choose a plan that matches your energy right now: reduce, stabilize, or pause spending

Small progress still counts. You don’t have to fix it all this month.

🧩 Milestone 7: Automate What You Can

Make fewer decisions. Let systems do the work.

- Automate a tiny savings transfer

- Set a calendar reminder to review autopays

- Automate a bill that you often forget

Less chaos = more calm.

✍️ Milestone 8: Write Down One Lesson You’ve Learned

You’ve made it this far. That alone is worth something.

- What would you tell someone younger about money?

- What mistake did you survive — and what did it teach you?

- What’s something you’re doing better now?

This is part of your legacy, whether you share it or not.

This milestone overlaps with the Reflect path of the PIM Midlife Map — because writing your money story isn’t just about closure. It’s a way to reclaim it, share it, and shape what comes next.

If you’ve never written down your money story, that’s something I gently guide you through inside the Reflect path.

📜 Milestone 9: Define What “Enough” Looks Like for You

Your version of success doesn’t have to look like anyone else’s.

- What would make you feel steady?

- What do you actually need — not in fantasy, but in this season?

- What can you stop chasing?

The Rebuild Path isn’t about becoming rich. It’s about feeling ready.

🪪 My Personal Reflection

In my 40s, I hit a point where I was just tired of working hard… and watching my money disappear without anything to show for it. I wasn’t trying to be perfect — I just didn’t want to feel so wasteful. So I started asking myself better questions before spending: Do I already have something that works? Can I borrow or repurpose instead? Is this really solving a problem — or just filling a feeling? [Inspired by the Buyerarchy of Needs]

That small mindset shift helped me save more and put extra toward my debt — without feeling like I was depriving myself. I still have a long way to go, but I know now that every dollar I don’t spend out of habit gives me a little more power back.

🔨How These Milestones Shaped My Solo Money System

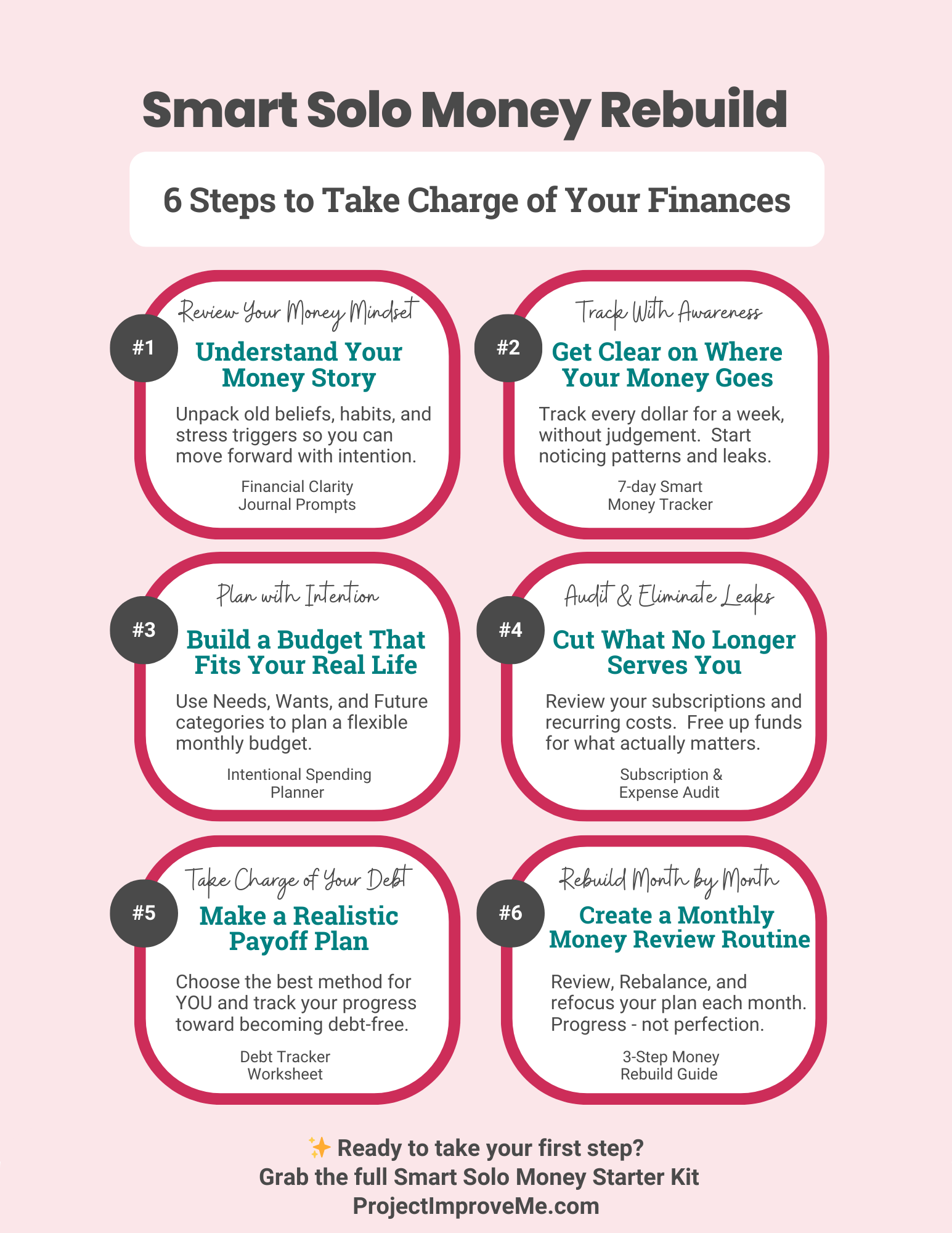

These nine milestones aren’t just a list — they’re the reason I created the Smart Solo Money Kickstart Bundle.

Inside the kit, I help you:

✔ See what’s coming in and going out

✔ Get your bills, debt, and essentials on one simple sheet

✔ Pause before spending on things that don’t actually help

✔ Make space for what matters — not just financially, but emotionally too

It’s based on what I call the Smart Solo Money System — practical tools for women managing money on their own (or feeling like they are).

Because money doesn’t live in a vacuum. It touches everything.

And if you’ve ever tried to rebuild your finances while also juggling digital overwhelm or family caregiving?

You already know this:

It all connects.

Most of these milestones live inside the Rebuild path of the PIM Life Map — but some overlap with the Reset and Reflect paths too. Because money isn’t just math. It’s clutter, caregiving, confidence, and all the life you’ve lived through to get here.

Want a little more help with your money?

Explore Smart Solo Money for simple ways to organize your finances and reduce money-related stress.

PIM Community Question

What money milestone are you working on right now — or proud to have already done?

I’d love to hear your story. Leave a comment or email me anytime.

Project: Improve Me! – Home of the Second Chapter Solution Studio™

Custom tools for women simplifying life after 40.

More about me and my mission: 👉🏼 HERE

Hi! I’m Kari. I started Project: Improve Me in 2025, right after turning 50, because I wanted something more meaningful than just spreadsheets and journal entries. I’m a single grandma working in accounting, and I see so many women overwhelmed at this stage of life. That’s why I’m here — to help midlife women get their digital lives in order, stress less about money, and share their stories… even if no one’s asking for them. It’s not about fixing your whole life overnight, just making it a little easier one step at a time.

.

Pin This Post: