Because freedom comes from more than just cutting back.

Why This Step Matters More Than Ever

Once you’ve tracked your spending, cleaned up your budget, and started paying down debt, there’s a natural next step—building a future you actually want.

And that starts with growing wealth your way—even if you're starting later or rebuilding after life threw you off course.

💡 This post is part of the Smart Money Management Series — your step-by-step guide to financial confidence for independent women. Visit the Smart Solo Money Hub » to see all 6 parts and grab your free Quick Win Guide!

🌱 What Growing Wealth Really Looks Like (Spoiler: It’s Not Fancy)

Wealth isn’t just big houses or six-figure salaries. It’s security.

It’s options.

It’s waking up and knowing you’re okay—even if something unexpected happens.

You don’t have to be perfect with money to build wealth. You just need to start making small, steady moves in the right direction.

💡 Fact: According to Abacus Wealth, 50% of women became more interested in investing after the pandemic. You’re not behind—you’re right on time to take control of your future.

💼 Let’s Talk Earning More (Without Burnout)

In midlife, your time and energy are precious.

So let’s focus on aligned income—opportunities that support your life, not drain it.

Here are a few gentle ways to boost your earnings:

- Use your skills in new ways (consulting, tutoring, freelance work)

- Raise your rates—or ask for the raise you deserve

- Sell or repurpose things you already own

- Turn a hobby into income (if it brings you joy)

🧍♀️ Solo Tip:

What feels doable right now? Start there. Progress builds momentum.

📊 Let Your Money Start Working Too

Even small investments can make a big difference over time—especially when you automate them.

Start with the basics:

- $25/month into a Roth IRA or index fund

- Auto-transfers to a high-yield savings account

- Learn from women-centered platforms like Ellevest or Fidelity’s Women Talk Money

Want to come back to this later?

🧍♀️ Solo Tip:

Building wealth is like planting a garden—start with a seed, and keep watering it.

🔁 What If You're Starting Late?

Many of us hit 40 or 50 and think, “Is it too late to build wealth?” The answer? Absolutely not.

You’re not behind—you’re just getting started with experience.

Maybe you were caregiving.

Maybe life derailed your plans.

Maybe money was just too overwhelming to deal with before.

That doesn’t disqualify you. In fact, it makes you resilient.

Try this instead:

- Set one mini-goal with each paycheck

- Track your savings and celebrate small wins

- Stop judging your timeline and focus on what’s possible now

💬 You don’t have to be wealthy to build wealth. You just need a plan—and permission to do it at your pace.

🧠 Want to learn more? Ellevest’s free money newsletter and insights for women is a great place to begin. They have all women Certified Financial Planners that really understand the struggles we go through and really want to help.

🎉 You’ve Completed the Smart Money Series!

👏 You’ve taken action on all 6 parts—from awareness to planning, protection to growth.

Now, it’s time to keep going.

- Revisit the Ultimate Smart Solo Money Guide

- Explore tools in the Freebie Vault

- Or check out the Project: Improve Me Shop for companion workbooks and trackers

👉 If you know a woman navigating money solo, send her this series. We’re better together.

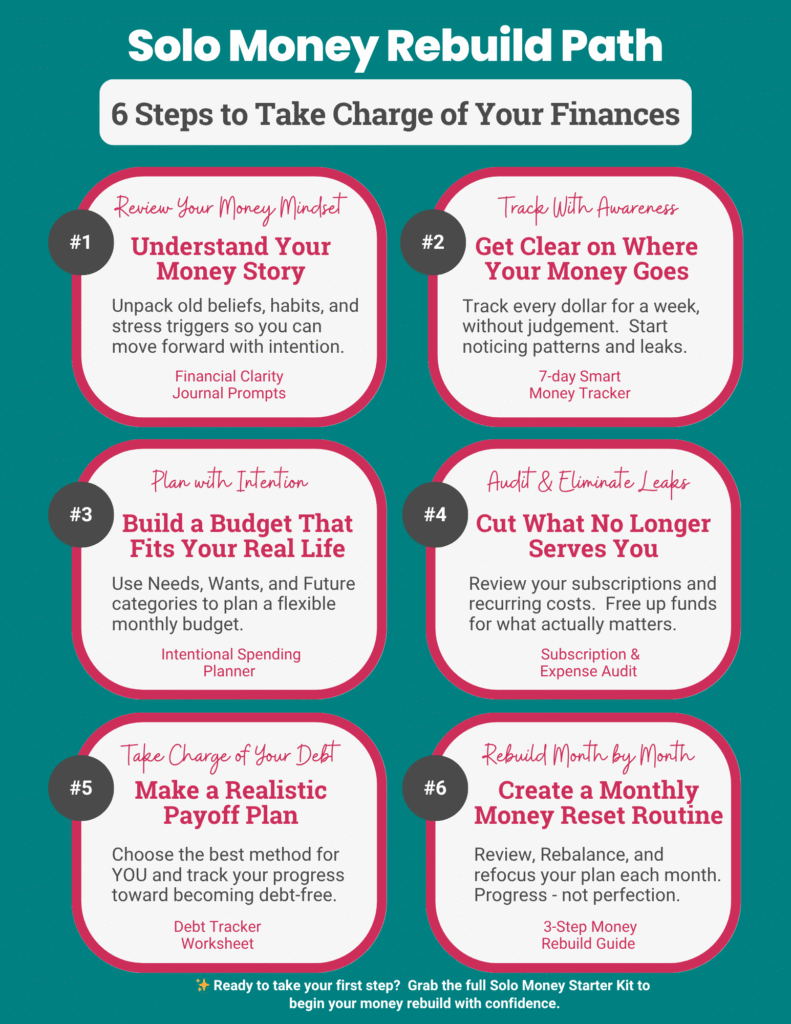

🎁 What’s Inside the Smart Solo Money Starter Kit?

The Starter kit includes PDF and Google Sheets for every step of your Smart Money Rebuild journey:

- Financial Clarity Journal Prompts – to reset your mindset and move forward with intention

- 7-Day Smart Money Tracker – to build awareness without overwhelm

- Intentional Spending Planner – to help you budget using the Needs, Wants & Future method

- Subscription & Expense Audit – to cut what no longer serves you

- Debt Tracker Worksheet – to create a personalized payoff plan

- 3-Step Monthly Money Reset Guide – to help you stay flexible and focused all year long

Want a little more help with your money?

Explore Smart Solo Money for simple ways to organize your finances and reduce money-related stress.

👉 Grab your Starter Kit now and take the next confident step on your Smart Solo Money journey.

Pin This Post: