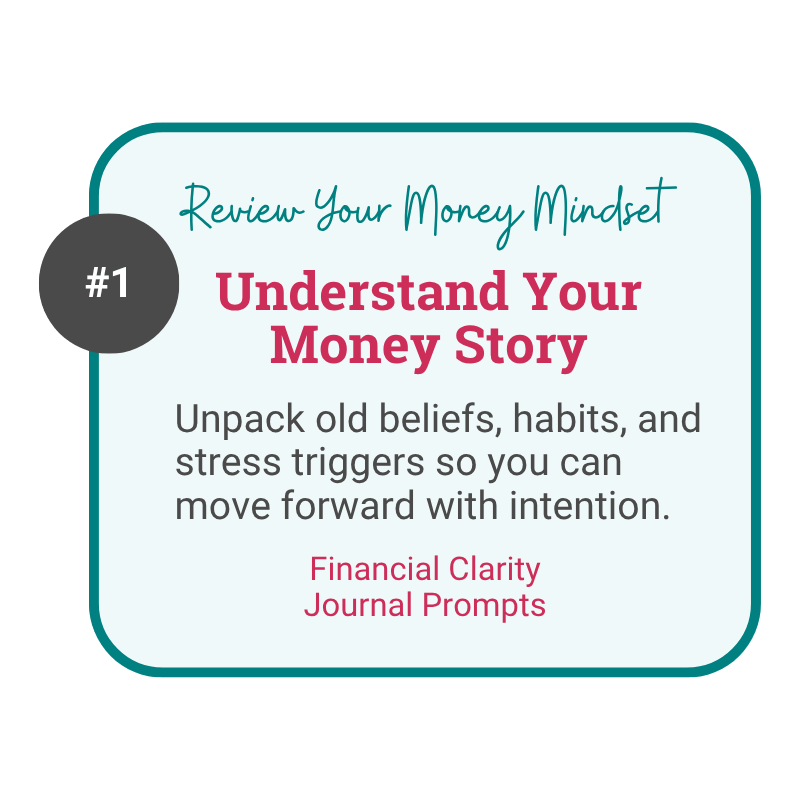

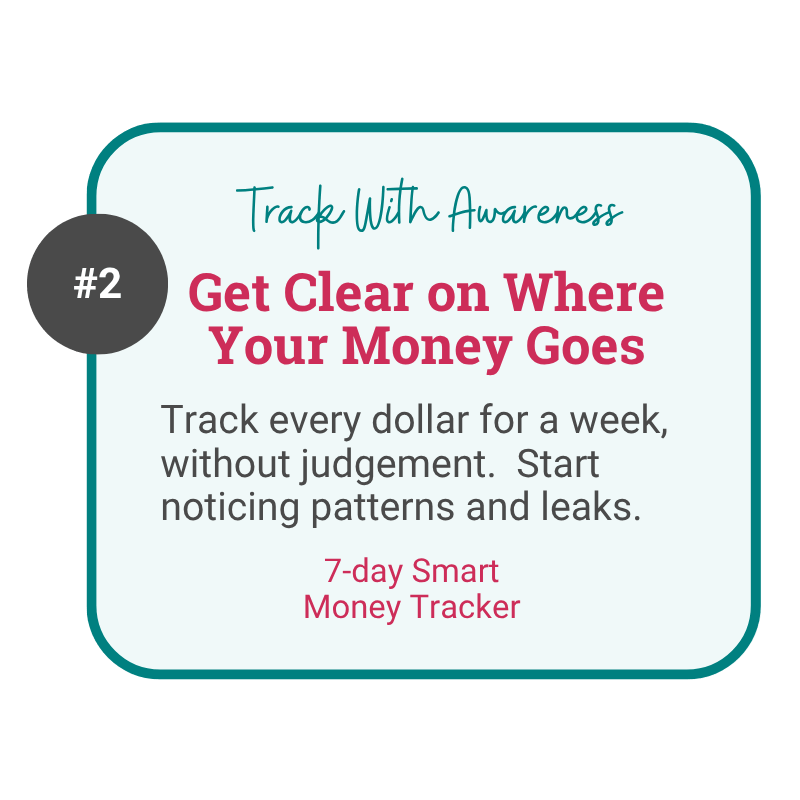

The first 3 steps of the Solo Money Rebuild™ Path:

- Reflecting on your mindset

- Tracking your spending

- Categorizing what matters

Managing money solo comes with unique challenges, but the first step to financial confidence is simple: know where your money is going. You don’t need to track every penny or feel restricted—just build awareness.

But before you open a spreadsheet or notebook, take a deep breath and ask yourself:

💬 “What do I believe about money?”

“Am I avoiding my finances because I feel overwhelmed… or ashamed?”

“What do I want money to do for me?”

This isn’t about perfection—it’s about getting curious, not critical.

Start by exploring your personal money story. The Solo Money Starter Kit includes simple journal prompts to help you reset your mindset before tracking. These questions help uncover emotional blocks, habits you didn’t know you had, and beliefs that may be holding you back.

Once you’ve reflected, you’re ready to start tracking with clarity and confidence..

💡 This post is part of the Smart Money Management Series — your step-by-step guide to financial confidence for independent women. Visit the Solo Money Hub » to see all 6 steps and grab your free Starter Kit!

Just a Heads Up! 🌟 This post may contain affiliate links, which means I might earn a small commission (at no extra cost to you) if you make a purchase through one of these links. As an Amazon Associate, I earn from qualifying purchases. But don’t worry—I only recommend products and services I personally use, love, or believe can genuinely benefit you. Your support helps keep this blog going—thank you! 💖

Why Tracking Your Spending Matters

If you’ve ever felt like your paycheck disappears without knowing where it went, you’re not alone. Tracking your spending isn’t about budgeting harder—it’s about understanding your money flow so you can make smart, informed choices.

💡 Good news? You don’t need a complicated system—just a simple, consistent way to track your spending that fits your lifestyle.

Step 1: Shift Your Mindset – No Guilt, Just Awareness

Forget strict budgeting rules for now—your only goal is to observe where your money goes for the next week or two. No judgment, no guilt—just awareness.

🔹 Action Step: Commit to tracking for 7-14 days without making any changes. You’re just collecting data.

Step 2: Choose a Tracking Method That Works for You

Everyone tracks money differently. Find what fits your lifestyle:

Want to come back to this later?

- Google Sheets / Excel → Best for structured tracking and detailed analysis (Use the Free Solo Money Starter Kit + Companion File!)

- Budgeting Apps (YNAB, PocketGuard, CountAbout, etc.) → Great for automated tracking

- Notebook / Planner Method → Ideal for those who prefer handwriting their numbers

Step 3: Track the Categories That Matter

Instead of stressing over every expense, focus on three core spending categories: ✅ Your Needs (Rent, utilities, insurance, groceries, gas, medical) ✅ Your Wants (Dining out, shopping, fun) ✅ Your Future (Savings, investments, debt repayment)

🔹 Action Step: Track just these three categories for one to two weeks using your preferred method.

🧍♀️Solo Tip: You don't need to track everything. Start with your top 3 categories (Needs, Wants, Future), and build confidence from there.

Step 4: Review & Identify Patterns

After tracking, look at your spending. Ask yourself:

- Where is most of my money going?

- Are there any unexpected money leaks?

- Am I spending in line with my priorities?

🔹 Action Step: Highlight 1-2 areas where you might want to make changes.

Step 5: Make Small, Smart Adjustments

Tracking your spending isn’t about eliminating fun—it’s about intentional choices. Now that you have awareness, you can make small adjustments that align your spending with your goals.

Examples of small but effective changes:

- Swapping unused subscriptions for something more valuable.

- Allocating a “fun spending” category to avoid guilt.

- Setting up automatic savings before you spend.

Want a little more help with your money?

Explore Smart Solo Money for simple ways to organize your finances and reduce money-related stress.

Final Thoughts: Make Tracking a Habit, Not a Chore

Tracking your spending is a tool for financial confidence—not a restriction. The more you do it, the easier and more empowering it becomes.

👉 Next up in the Smart Money Management Series: Step 2 – Identify Money Leaks & Stop Wasting Cash

🎁 Need a simple way to get started?

Download the free Solo Money Starter Kit to track your spending, find hidden money leaks, and start making empowered money moves.

Pin This Post: