I remember the first time I sat down to track my spending—it felt overwhelming, and honestly, I wasn’t even sure where to start. Was I doing it wrong? Was I missing something? But here’s the thing—you don’t need to be a financial guru to take control of your money.

You just need a starting point.

This blog series is like your personal money reset button (without the stress). We’ll walk through six doable steps that help you rebuild a financial life that’s both realistic and empowering—especially if you’re managing everything solo.

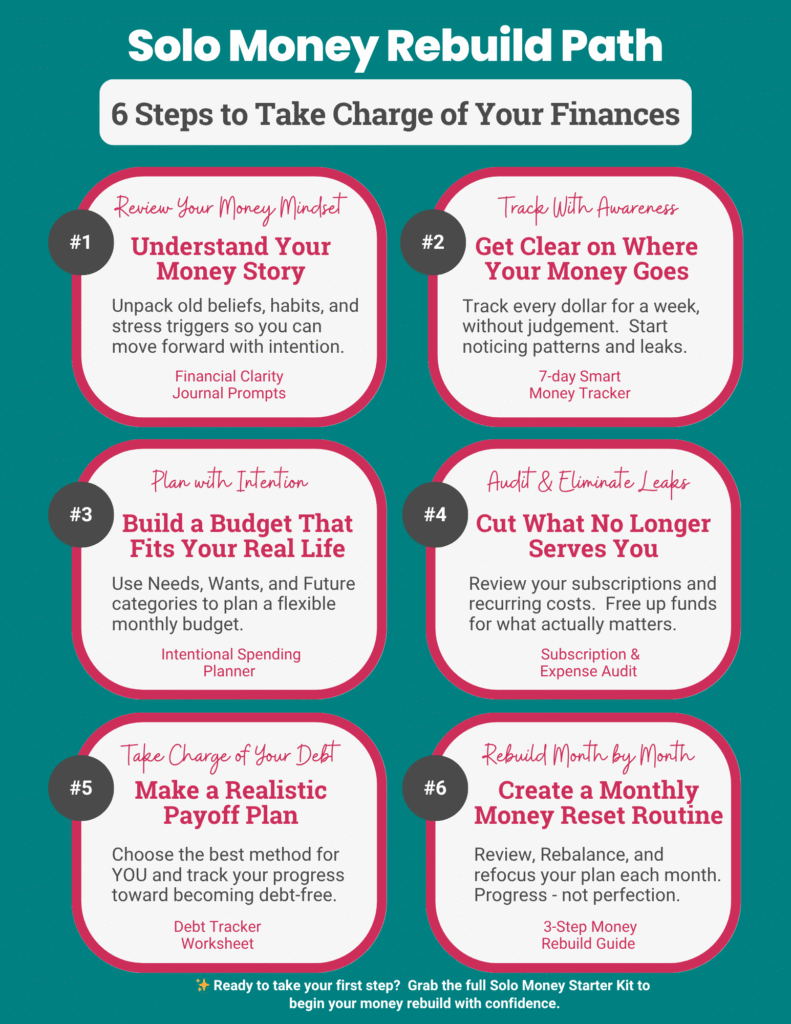

Introducing the Solo Money Rebuild™ Path

6 Steps to Take Charge of Your Finances—One Small Win at a Time

✨ This is the same path you'll find inside the Solo Money Starter Kit and the Smart Money blog series. Each step comes with a matching worksheet to guide you!

Step 1: Reflect & Reset Your Mindset

Check out the Smart Money Series part 1 for more on Step 1!

Before we get to tracking and numbers, let’s pause.

Your money habits didn’t come out of nowhere. They’re shaped by how you were raised, what you’ve been through, and what you believe about money today. That’s why we start with a mindset check-in.

“What’s my first memory of money?”

“Do I feel guilt, fear, or freedom when I think about spending?”

You’ll find guided prompts in the Starter Kit to help you reflect—and release what’s no longer serving you.

🧰 Use the Financial Clarity Journal Prompts

Step 2: Track Your Spending Without Stress

Check out the Smart Money Series part 2 for more on Step 2!

Now that your mindset is grounded, let’s start tracking—no guilt, no pressure. Just notice what’s happening with your money.

Use a notebook, spreadsheet, or app. Don’t change anything yet—just watch.

It’s like checking your weight before starting a fitness plan: just data, not a judgment.

🧰 Use the 7-Day Smart Money Tracker

Step 3: Identify Money Leaks

Check out the Smart Money Series part 3 for more on Step 3!

Once you’ve tracked your spending, it’s time to see where your money might be sneaking off to without your permission.

Look for:

- Subscriptions you forgot about

- Impulse buys that didn’t bring lasting joy

- High-interest payments draining your budget

Even a $15 charge here or there adds up—and freeing that up can fund your peace of mind.

🧰 Use the Subscription & Expense Audit Checklist

👉 Quick Fix:

Highlight any expenses that feel unnecessary or could be adjusted. Even a $20/month subscription you forgot about is $240 a year back in your pocket—enough for a weekend getaway or a boost to your emergency fund!

Want to come back to this later?

Step 4: Build a Financial Safety Net

Check out the Smart Money Series part 4 for more on Step 4!

If you’re the only one bringing in income, building a small buffer is essential—not optional.

This doesn’t have to mean saving thousands overnight. It starts with simple habits:

- Reroute a canceled subscription into a savings jar

- Set up an “Oops Fund” for life’s mini surprises

- Automate a small transfer each week

🧰 Use the Emergency Fund Tracker (or write it in the margins of your Starter Kit)

Step 5: Manage Debt Without Shame

Check out the Smart Money Series part 5 for more on Step 5!

Debt doesn’t make you bad with money—it makes you human.

Choose a method that feels good to you:

- The Snowball Method (start small, build momentum)

- The Avalanche Method (start with the highest interest first)

Just make one extra payment this month if you can. Small steps = real wins.

🧰 Use the Debt Tracker Worksheet

Step 6: Manage Debt Without Shame

Check out the Smart Money Series part 6 for more on Step 6!

Here’s the truth: no budget survives perfectly.

That’s why the Solo Money Rebuild™ Path ends with a gentle monthly reset:

- Reflect on what worked

- Adjust for what’s coming

- Set one simple goal for the month ahead

This is how progress happens—without shame or burnout.

🧰 Use the 3-Step Monthly Money Reset Guide

🧰 You’ll also get instant access to every printable I’ve created so far — from trackers to planning pages — all designed to help women like us feel confident, capable, and in control of our finances.

Pin This Post:

Final Thoughts

You don’t have to figure it all out today. You don’t even have to follow these steps perfectly.

But I hope this series helps you feel less alone—and more in control.

Grab your Starter Kit. Track your first week. Then come back and take your next step. I’ll be right here cheering you on. 💚

💬 Have any questions or insights about money management? Share them in the comments below—I’d love to hear from you!

Want a little more help with your money?

Explore Smart Solo Money for simple ways to organize your finances and reduce money-related stress.

Project: Improve Me! – Home of the Second Chapter Solution Studio™

Custom tools for women simplifying life after 40.

More about me and my mission: 👉🏼 HERE

Hi! I’m Kari. I started Project: Improve Me in 2025, right after turning 50, because I wanted something more meaningful than just spreadsheets and journal entries. I’m a single grandma working in accounting, and I see so many women overwhelmed at this stage of life. That’s why I’m here — to help midlife women get their digital lives in order, stress less about money, and share their stories… even if no one’s asking for them. It’s not about fixing your whole life overnight, just making it a little easier one step at a time.

.