Money advice for women usually falls into two extremes: “stop buying lattes” or “max out your 401k.”

But, what about the women in between? The women holding everything together, often on one income, while life keeps shifting under their feet?

That’s who this guide is for.

I know what it feels like to work hard, pay the bills, and still lie awake wondering, “Am I ever going to feel secure and stable?” Money at midlife isn’t just about numbers on a spreadsheet; it’s about security, dignity, and peace of mind when you’re carrying so much alone.

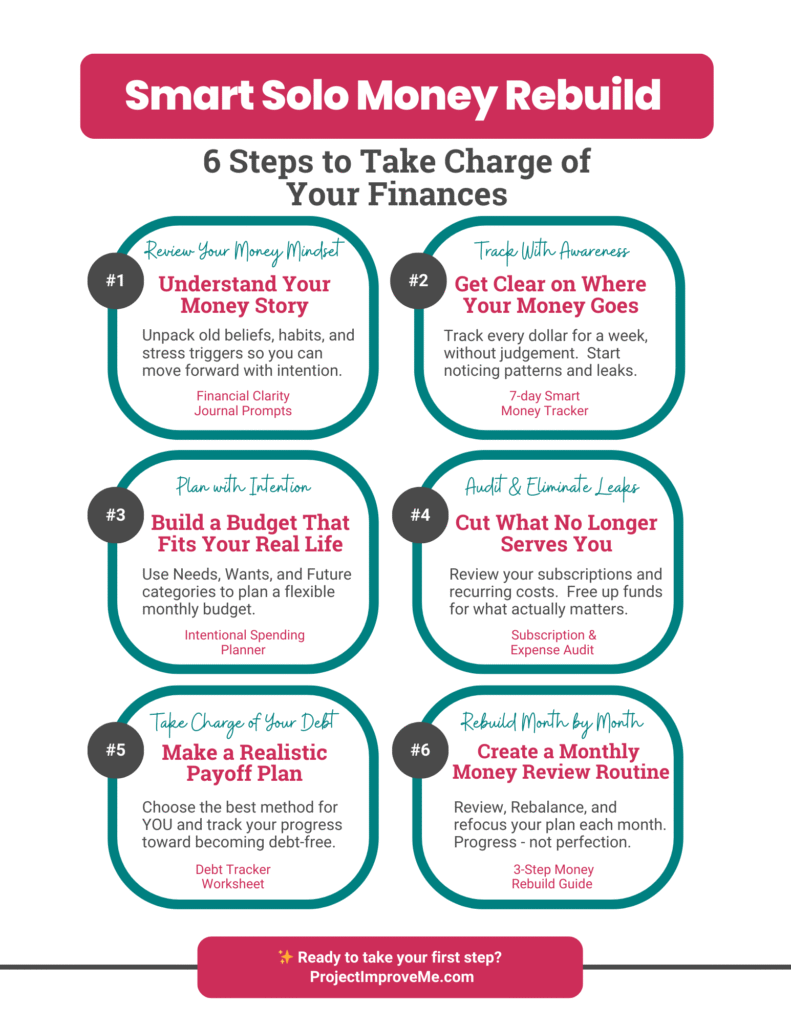

This isn’t about perfection or strict rules. It’s about rebuilding step by step, in a way that works for real life. By the end of this guide, you’ll know how to:

⇒ Understand your money habits without feeling guilty.

⇒ Spot and cut expenses that don’t really matter to you.

⇒ Build a budget that makes space for both peace of mind and a little fun.

⇒ Create a routine that helps you feel in control again.

You don’t have to do it all at once and you don’t have to do it alone. Let’s take this one step at a time.

Key Takeaways

- Many midlife women face financial pressures from multiple responsibilities, caregiving, and rising health costs.

- Understanding personal money stories helps in recognizing patterns that hinder financial decisions.

- Tracking daily expenses brings clarity and identifies areas for improvement in budgeting.

- Creating a flexible budget based on needs, wants, and future plans enables women to manage finances without guilt.

- The Smart Money Guide for Midlife Women outlines six actionable steps to regain control over finances and make informed decisions.

Why Midlife Finances Are Different

If you’ve ever felt like generic budgeting advice doesn’t fit your reality, you’re right; it doesn’t. Midlife money comes with a unique set of challenges that younger women or two-income households simply don’t face.

Here’s what makes this season different:

- One paycheck, many responsibilities. For many midlife women, there’s no second income to fall back on. If the car breaks down, if the roof leaks, or if hours get cut at work, it all falls on you.

- The “sandwich generation” squeeze. You might be paying for your teen’s braces while also covering your mom’s prescriptions. Separate accounts, multiple households, endless receipts. It is a lot!

- Health costs that creep in. Co-pays, supplements, insurance premiums… midlife health costs eat into budgets in a way that 20-somethings don’t have to plan for.

- Starting over, again. Divorce, widowhood, career shifts, or simply realizing your old system wasn’t working — midlife often means rebuilding from scratch.

- The weight of “too late.” Many women feel guilty for not saving enough earlier. That shame can be paralyzing, but it doesn’t have to define you.

🌺 If this is you, please know: nothing is wrong with you. The advice out there just wasn’t written for women living your reality. So let’s build a plan that actually makes sense for where you are now.

This guide is part of the Smart Solo Money Rebuild Path on the Midlife Map.

You can explore the full path here.

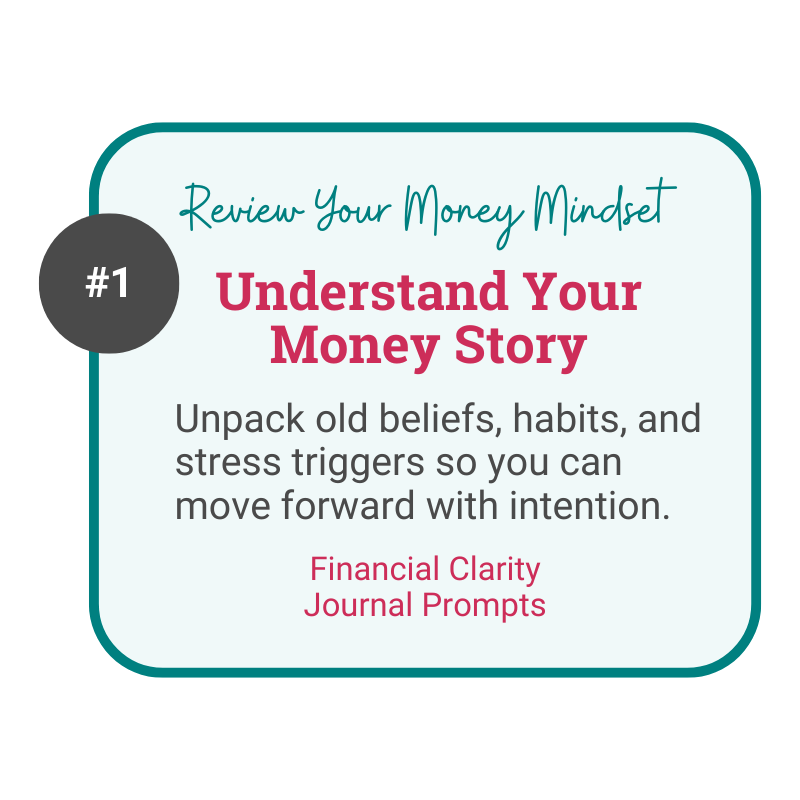

Step 1: Understand Your Money Story

Before we talk numbers, we need to talk about the stories you believe about money.

By midlife, most of us have decades of habits, lessons, and even wounds that shape how we handle money today. Maybe you were told “money doesn’t grow on trees.” Maybe you watched your parents fight over bills. Or, you’ve been the one keeping everyone else afloat, and it feels selfish to keep a dollar for yourself.

The truth? Those old patterns aren’t your fault. But they are powerful and they can quietly control your decisions until you bring them into the light.

This step isn’t about blaming yourself for the past. It’s about recognizing what shaped you, so you can decide what you want to keep and what you’re ready to release.

Try This

Take 10 minutes with a notebook or my Financial Clarity Journal Prompts (they’re inside the Smart Solo Money Starter Bundle if you already grabbed it or want it). Write down:

- Your earliest money memory.

- Something you were taught about money growing up.

- A money habit you’ve carried into adulthood.

- One belief you’d like to let go of.

- One new belief you’d like to replace it with.

🪻 Example: “I grew up hearing that debt is just part of life. I'm letting go of that belief and will replace it with: I can build security at any age.”

When you understand your money story, you stop running on autopilot. Instead of feeling like “I’ll never get ahead,” you begin to see possibilities and that’s where real change starts.

‼️Once you’ve uncovered the story behind your money habits, it’s time to see what’s happening right now, like where your money actually goes each day. → Step 2: Track With Awareness.

Step 2: Track With Awareness

Have you ever gotten to the end of the week and thought, “Where did my paycheck go?” That sinking feeling is so common in midlife. Between bills, kids, parents, groceries, and the little “just this once” extras, money seems to disappear fast.

Here’s the truth: you can’t change what you don’t see.

That’s why the next step is simply noticing where your money actually goes. Not judging. Not fixing. Just noticing.

Why This Step Works

Tracking your spending isn’t about being perfect; it’s about clarity. When you see the full picture, you can:

- Spot the leaks that drain your money but don’t make life any easier..

- Notice patterns (like how much family extras really add up).

- Make choices from a place of knowledge, not guilt.

Most women I talk to are shocked at how much peace comes just from writing it all down. Even before making changes, the anxiety of the unknown starts to fade.

Try This

For the next 7 days, jot down every expense. Big or small, monthly or one-off, just write it down. Label each one as:

- Need (essential for survival/security)

- Want (adds comfort or convenience)

- Future (savings, debt payments, cushion)

🔮 You can use a plain notebook, your Notes app, or my 7-Day Smart Money Tracker (included in the Starter Bundle). Here are some examples:

- Gas – $42 – Need

- Coffee – $4 – Want

- Extra debt payment – $50 – Future

At the end of the week, take 10 minutes to look back:

- What surprised you?

- Were there “wants” that didn’t feel as satisfying as you hoped?

- Is there a habit you’re proud of that you want to keep?

Midlife Reality Check

When you’re balancing kids’ sports fees, your mom’s prescriptions, and your own rising grocery bill, it’s easy to feel like there’s never enough. Tracking shows you the truth and sometimes, the truth is that you’re doing better than you give yourself credit for.

‼️Now that you can see where your money actually goes, the next step is giving it a plan; one that fits your real life and makes space for both security and joy. → Step 3: Build a Budget That Fits Your Real Life.

Step 3: Build a Budget That Fits Your Real Life

Most women I talk to tell me they’ve “failed at budgeting” at least once. But you didn’t fail. The system failed you.

Traditional budgets like 50/30/20 or 70/20/10 sound simple, but they often don’t fit midlife reality. One month, you’re paying for car repairs and your mom’s meds. The next month, it’s dental work, groceries that keep getting more expensive, or a last-minute trip to see your grandkids.

Real life doesn’t fit neatly into a formula and your budget shouldn’t make you feel guilty when it doesn’t.

The Needs / Wants / Future Framework

Instead of strict rules, I use a simple three-part plan:

- Needs → essentials like housing, food, utilities, insurance.

- Wants → joy, comfort, hobbies, extras that make life a little lighter.

- Future → debt payments, cushion savings, retirement.

That’s it. Just three buckets you can adjust as life changes.

Why Flexibility Matters

Some months, you might spend more on Wants, like a concert ticket, a trip, or just a few more dinners out. Other months, you might not spend on Wants at all, and all your extra goes to bills or savings. It balances out over time.

You don’t need to feel guilty for enjoying your life. Fun is not the enemy of financial stability. It’s what makes the hard work worth it.

🌟 I’m creating a big list of free and low-cost ideas for fun, connection, and self-care that don’t wreck your budget. That way, even when money feels tight, you’ll have plenty of ways to enjoy life extra-guilt-free. Watch for it here soon!

Try This

- Write down your total monthly income.

- Divide it into Needs, Wants, and Future. (You can start with 50/30/20, but adjust as your reality demands.)

- Choose one small weekly amount (even $10–20) to start building your Safety Cushion.

- At the end of the month, ask yourself:

- Did I spend on what mattered most?

- Did I leave myself short by helping others too much?

- What one change will make next month feel better?

Midlife Reality Check

A budget isn’t about restriction. It’s about giving every dollar a job that reflects your values and priorities. Some months that job is security. Other months it’s comfort or fun. Both matter.

‼️Once your plan is in place, the fastest way to make progress is freeing up more dollars. That’s where Step 4 comes in: cutting what no longer serves you.

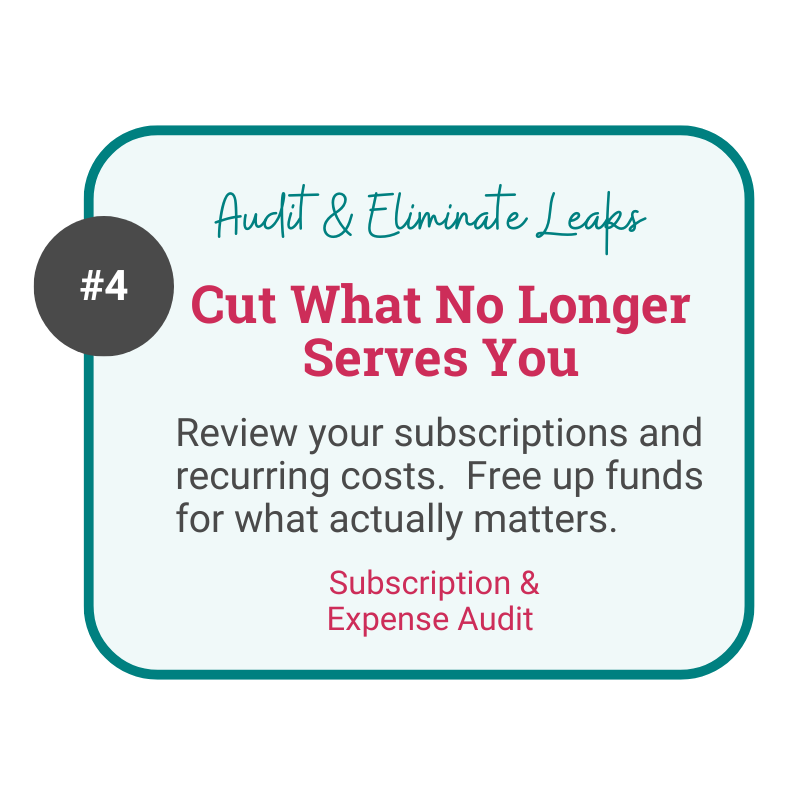

Step 4: Cut What No Longer Serves You

Once you’ve built a plan, the next step is creating breathing room. The fastest way to do that isn’t working more hours. It’s by cutting the hidden expenses that quietly eat away at your money.

Most women I talk to are losing $50–$100 every month on things they don’t even use: an old app subscription, a duplicate streaming service, a gym membership they feel guilty canceling. That’s money that could go toward your cushion, debt payoff, or something that actually brings joy to your life.

Why This Step Matters

Cutting expenses isn’t about sacrifice. It’s about choice. Every dollar you free up is a dollar you can redirect to your Future or to a Want that truly makes you happy.

Think of it like decluttering your home: you don’t need five sets of dishes, and you don’t need five monthly streaming services either.

Try This

Grab my free Subscription & Expense Audit Worksheet (form below.) I estimated it would take about 20 minutes or less, but to be honest the first time I did it, it took much longer. I had no idea what I was paying, where it was being paid from, or when it was auto-drafted. Take your time and get it ALL out. Make a list of:

- Every subscription, bill, and auto-charge.

- Decide: Keep, Cancel, or Adjust.

- Redirect the savings, even if it’s just $20, to your cushion, debt, or a priority that matters.

🚨 Canceling a $15/month subscription = $180 a year. That’s a car repair fund, a weekend trip, or 3–4 extra debt payments.

Use the online subscription audit tool I created by uploading your bank csv file to check for duplicate charges or just a complete list of items you pay for on a regular basis so you can decide to Keep, Cancel, or Adjust. → Go Here (& select “Wake Up” if asked)

Common Places Midlife Women Find Money Leaks

- Home & Utilities: streaming services, duplicate cloud storage, extra internet packages.

- Family & Caregiving: helping with kids’ phone bills, auto-ship orders for parents.

- Health & Wellness: unused gym memberships, forgotten supplement subscriptions.

- Hidden Charges: trial apps that became monthly bills, duplicate insurance add-ons.

Midlife Reality Check

When you’re caring for everyone else, it’s easy to keep paying for things out of habit or guilt. But every time you say NO to an expense that no longer serves you, you’re saying YES to your own security and peace of mind.

‼️Once you’ve freed up some extra dollars, the next step is deciding how to tackle your debt in a way that feels realistic, not overwhelming. → Step 5: Make a Realistic Payoff Plan.

Step 5: Make a Realistic Payoff & Protection Plan

Debt feels even heavier when you’re carrying it alone. And sometimes paying it down has to wait. Keeping the lights on, making sure the car runs, or filling a prescription will always come first.

This step is about giving yourself permission to focus on survival first, while also creating a system that helps you keep moving forward when life calms down.

1. Minimums Are Okay

If you’re in survival mode, pay the minimum on all debts for now. This gives you some breathing room until you can get back on track.

2. Sort Your Debts Into “Grace” and “No Grace”

Not all bills are created equal. Some must be paid immediately. Others give you wiggle room. Knowing the difference can make a tough month less overwhelming. Make a list of every bill and debt. Ask yourself:

- Which ones must be paid on time (no grace period)?

- Which ones allow extensions, grace days, or flexibility?

☑️ Here are examples from my own experiences about Grace. Sometimes all you need is a little to get by.

- Car Insurance: Usually allows a 9-day extension, just enough to get me to the next paycheck.

- Mortgage: Doesn’t report late to credit bureaus until about 28 days past due. Many lenders give 15 “grace days” with no fee, then a small late fee after.

- Electric, Water, Trash: Often allow extensions if you request them, or set a cut-off date before shutoff.

- Cell phones/Cable: Can usually be split into payments, and service turns back on quickly once you pay.

- Car Payment: Often up to 30 days late with late fees, but repossession is a risk if you push too far.

- Credit Cards: Some waive late fees if you call, but missed payments can hit your credit.

- IRS/Tax/Legal Debt: No grace here. Always handle these first! They’ll usually work out a payment plan, but ignoring them makes things worse.

🚨This isn’t about skipping bills to splurge. It’s about knowing which bills can wait and which absolutely can’t. That list becomes your First Aid Kit when money is super tight.

🗨️A Real Talk Moment

Most “financial gurus” won’t say this out loud, but real life is messy. I was a single mom from the time I was 17 and money was always tight. I didn't have enough hours in the day to earn more or any fancy stuff to sell for cash, like most suggestions nowadays. I’ve delayed a car payment so my son could play sports, and I’ve put off car insurance for a few days so I could take him out for a birthday dinner and cake. These may not qualify as “needs” to some people, but they were to me. Trust me, just keep going and it will get better, even when it feels like it won't.

And credit scores? Yes, they matter when you’re renting or buying a home. But when you’re in survival mode, a late fee or a small ding won’t ruin you forever. What matters most is protecting your essentials and keeping yourself safe.

3. Build Savings Habits (and Protect Them)

Even while paying minimums, start building a tiny untouchable cushion. Even $10–$20 a week adds up. But here’s the key: decide in advance what really counts as an emergency.

- Emergency: brakes fail, urgent medical need, job loss.

- Not an emergency: a birthday gift, a “sale” item, or something that can be planned for.

The habit of saving and keeping it saved is more important than the dollar amount. Protect these funds. You'll never know when they'll be the lifesaver you need.

4. When You're Ready, Plan the Payoff

Once your essentials are stable and you’ve started building a cushion, then it’s time to focus on debt payoff.

- Triage First: Always handle IRS, court fines, or payday loans before anything else.

- Snowball Method: Pay smallest balances first. Quick wins = motivation.

- Avalanche Method: Pay highest-interest debt first to save the most money long-term.

🌟 Use the Debt Tracker Worksheet (in the Starter Bundle) to watch your balances shrink over time. And if you like spreadsheets, I designed my own Debt Snowball Calculator in Excel. Most versions felt too small, so I built one with room for 30 debts and those extra little “snowflake” payments. I’m polishing it up now to share in my Smart Solo Money store soon.

5. Midlife Reality Check: The Hard Trade-Offs

For many women, the hardest part isn’t the numbers. It’s the choices:

- Maria, 52: Brakes vs. keeping the lights on.

- Angela, 47: Student loan vs. braces deposit.

- Sharon, 58: Husband’s meds vs. skipping them to pay bills.

These aren’t abstract examples. They’re the gut-punch decisions real women, like us, face every single day. Having a plan doesn’t erase the pain, but it does give you a framework so you’re not making life-or-death decisions in panic mode every single month.

Quick Win Idea

Even an extra $25 toward one debt (while making minimums on the rest) can cut months off your timeline. Small steps matter.

‼️ Now that you’ve got a survival strategy and a plan for debt, the final step is creating a simple monthly routine — a regular check-in that keeps you on the right track without the stress. → Step 6: Create a Monthly Money Review Routine.

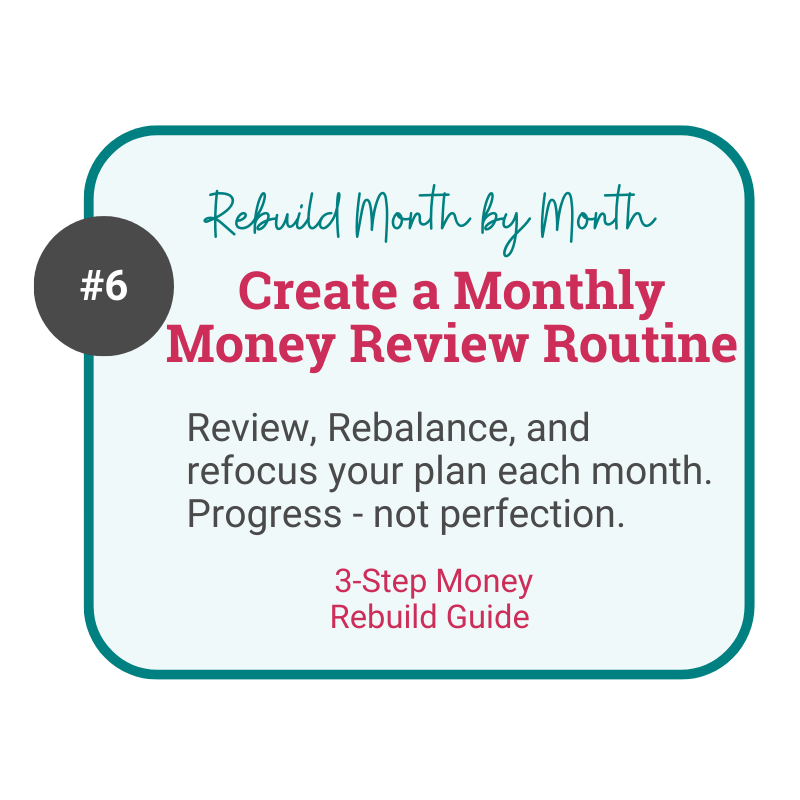

Step 6: Create a Monthly Money Review

Budgets don’t fail because we’re “bad with money.” They fail because life is busy and there’s no simple routine to keep things on track.

That’s where a Monthly Money Review comes in. Think of it as a quick money check-up, like brushing your teeth. It doesn’t take long, but it keeps problems from piling up. *Disclaimer: I suggest a monthly review, but it's ok to do it weekly, or whatever works for you. I'm on a weekly routine – but I'm an accountant and Excel nerd. 😂

Why This Step Matters

When you set aside just 20–30 minutes once a month to review your money, you:

- Catch small problems before they turn into emergencies.

- See your progress (even if it’s small, it builds confidence).

- Feel less anxious because you know where you stand.

Try This: The 20-Minute Money Review

- Review your spending: Look back at last month’s Needs, Wants, and Future. Where did the money actually go?

- Check your cushion: Is it growing, or did you dip into it? If you did, ask if it was a true emergency or just something that could’ve waited.

- Adjust for this month: Big bills coming? Kids’ activities? Upcoming repairs? Make space now instead of scrambling later.

- Celebrate a win: Paid off a debt? Saved $50? Even just stuck to writing things down? Count it because it absolutely matters.

🚨You can use my Monthly Money Review Worksheet (inside the Starter Bundle) to make this easy.

Midlife Reality Check

Some months you’ll nail it. Other months will feel like a mess. That’s normal. What matters most is showing up again next month. Consistency beats perfection every single time [in all areas of life].

Quick Win Idea

Pick a day or date that’s easy to remember – like the last Sunday of the month – and set a recurring reminder on your phone. Make it a ritual: grab your coffee, sit in your favorite spot with some calm music, and do your money review.

‼️ Now you’ve got all 6 steps: from uncovering your money story to creating a monthly review. This isn’t about a one-time fix; it's a path you can keep walking, at your own pace, to feel safe and in control of your money again.

Quick Wins (When You're Overwhelmed)

If you’re feeling like this is a lot, you’re not alone. Big changes can feel heavy, but small wins add up faster than you think. Here are a few money wins you can grab in 10 minutes or less:

- Cancel one subscription you don’t use. Even $10/month saved is $120/year back in your pocket.

- Write your top 3 bills into “Grace” and “No Grace.” Just seeing which ones can wait helps calm the panic when money’s tight.

- Skim your bank statement for one money leak. Look for auto-renewals, doubled charges, or something you didn’t realize was still hitting your account.

- Set up a tiny automatic transfer. Even $5 a week into savings builds the habit and the habit is more important than the amount.

- Name your money cushion. Call it “Peace Fund,” “Emergency Comfort,” or anything that makes you smile. Naming it makes it harder to dip into for non-emergencies.

- Celebrate a win you’ve already had. Paid a bill on time? Said no to an unnecessary purchase? That counts. Write it down and own it.

🎯Explore the full Smart Solo Money Rebuild Hub for tools, resources, and related posts.

Want to come back to this later?

Beyond the Basics

Once you’ve worked through the six steps and found your footing, you may start asking bigger questions about your future. Midlife is the perfect time to think ahead, not because you “should have done more sooner,” but because now you know yourself better and you’re ready to build a plan that fits your life today.

Here are some areas you can begin exploring when you feel ready:

- Retirement catch-up strategies. It’s not too late. There are tax-advantaged ways to accelerate savings in your 40s, 50s, and 60s.

- Planning for long-term care. Thinking ahead about health costs, caregiving needs, or living arrangements can give you peace of mind.

- Insurance & estate planning. From life insurance to wills, these steps make sure you and your loved ones are protected [pets included 🥰].

Trusted External Resources

Sometimes the best next step is simply knowing where to turn for reliable information. Here are a few resources I found that seem legit and useful:

- AARP Money Tools – practical midlife-friendly calculators and guides.

- National Foundation for Credit Counseling – nonprofit credit counseling and debt help.

- U.S. Department of Labor Women’s Bureau – Retirement Resources – resources tailored for women planning their financial futures.

- Savvy Ladies – free financial helpline for women in major life transitions.

- WISER – Women’s Institute for a Secure Retirement.

- Modern Widows Club – community and resources for women after loss.

‼️You don’t need to dive into all of this right away. Just know that there is a path forward beyond today’s bills, and I’ll continue sharing tools and guides to help you when you’re ready.

❓SMART SOLO MONEY FAQs

Absolutely not. Midlife is actually the perfect time. You know yourself better, you’ve survived ups and downs, and you’re clearer on what matters most. Small, consistent changes now can set you up for stability and peace of mind in the years ahead.

Both matter, but survival and stability come first. If money is tight, focus on paying the minimums and start building a small cushion, even $10–20 a week. Once you’ve got breathing room, you can shift more energy into debt payoff.

Freelance, hourly, or commission-based income can make budgeting feel impossible. The key is building a baseline budget around your minimum guaranteed income. Anything extra goes toward savings, cushion, or debt. That way, you’re never counting on money that hasn’t arrived yet.

Remind yourself: guilt doesn’t pay bills, but action does. Everyone has made choices they’d do differently. The fact that you’re here, reading this guide, means you’re already moving forward. Let go of “perfect” and aim for progress.

That’s a heavy feeling, and I’ve been there too. The way out is one step at a time. Track where your money goes. Build your Grace/No Grace list. Make your first $25 extra payment. Each step gives you a little more control and those steps add up faster than you think.

Yes, because a budget isn’t just about bills. It’s about creating space for wants and future without guilt. Without a plan, the extras slip away unnoticed. With a plan, you’ll feel empowered to say, “Yes, I can spend on this,” or “No, I’d rather put that toward my cushion.”

This is one of the hardest struggles for midlife women. You’ve been the helper for so long — for kids, parents, partners, coworkers — that saying NO feels wrong. But remember: every dollar you give away without protecting yourself first means less stability for your own future. Helping others doesn’t have to mean hurting yourself. Start by setting a boundary: cover your Needs and Future first, then decide what extra you can give without guilt. You can’t pour from an empty cup and protecting your security is an act of love, not selfishness.

A Final Word of Encouragement

If you’ve made it this far, take a breath. You’ve already done more for your money today than most people will do all month.

Remember: you don’t need to tackle all six steps at once. Just start where you are. This could mean tracking your spending for a week. Or it could mean writing down your Grace/No Grace list. Maybe it’s setting up a $10 savings transfer.

Small steps matter.

Midlife is the perfect time to finally build money your way: without guilt and without trying to squeeze yourself into someone else’s formula.

You’ve carried so much for everyone else. Now it’s time to give yourself the same care, patience, and support you’ve been giving away for years.

I’m cheering for you and I’ll be here with tools, resources, and real-life guidance every step of the way.

Want to see how Smart Solo Money fits into the bigger picture? Visit the Midlife Map to explore all three paths: ClearMind Digital System, Smart Solo Money, and Pen Your Past.

What To Do Next

You’ve just walked through the six steps of the Smart Solo Money Guide. That’s a lot and you don’t need to do it all today. What matters most is that you start.

Here are a few simple next steps you can take right now:

- Pick one quick win from the list above and do it today. (Cancel a subscription, write your Grace/No Grace list, or transfer $10 to savings.)

- Grab the Smart Solo Money Starter Bundle. It’s $9 and packed with the worksheets, trackers, prompts, and flowchart that make these six steps easier to follow in real life. 👉 Check it out here.

- Get ongoing support. Get my free Subscription & Expense Audit by filling out the form below, or try one of my calculators on CalcMyCosts.com (my little side project). These quick tools will keep you moving forward without overwhelm.

If you’re wondering what progress looks like in real life, I created a list of 9 Midlife Money Milestones. These aren’t about perfection, they’re about noticing the small wins that add up. Read them here.

Want a little more help with your money?

Explore Smart Solo Money for simple ways to organize your finances and reduce money-related stress.

Remember:

You don’t have to figure this out alone. I’ve been where you are: juggling bills, carrying too much on one paycheck, and wondering how to feel safe and secure again. That’s why I built Smart Solo Money: to give midlife women a path that’s realistic, flexible, and supportive.

This is your fresh start. And I’ll be here to walk with you, one step at a time.

Project: Improve Me! – Because Your Second Half Should Be Your Best Half.

Hi! I’m Kari. I started Project: Improve Me in 2025, right after turning 50, because I wanted something more meaningful than just spreadsheets and journal entries. I’m a single grandma working in accounting, and I see so many women overwhelmed at this stage of life. That’s why I’m here: to help midlife women get their digital lives in order, stress less about money, and share their stories… even if no one’s asking for them.

It’s not about fixing your whole life overnight, just making it a little easier one step at a time.

Share or Save: Pin This Post

2 Comments